Key Consumer Insights on Plant-Based Dairy in 2022

Welcome to our new guide on consumer insights.

In this edition, you will find the most important consumer insights in 2022 regarding plant-based dairy, specifically:

- Why consumers are demanding plant-based dairy products

- An in-depth look at the key factors that go into it

- A practical example on how to win consumer trust

Now it’s time to share what we discovered.

Key Consumer Insights on Plant-Based Dairy in 2022

More and more, consumers are turning to dairy alternative products.

In fact, 47% of global consumers eat or drink plant-based dairy products.

There are several reasons why this is happening. So let’s jump right in and check out the key factors that go into this decision:

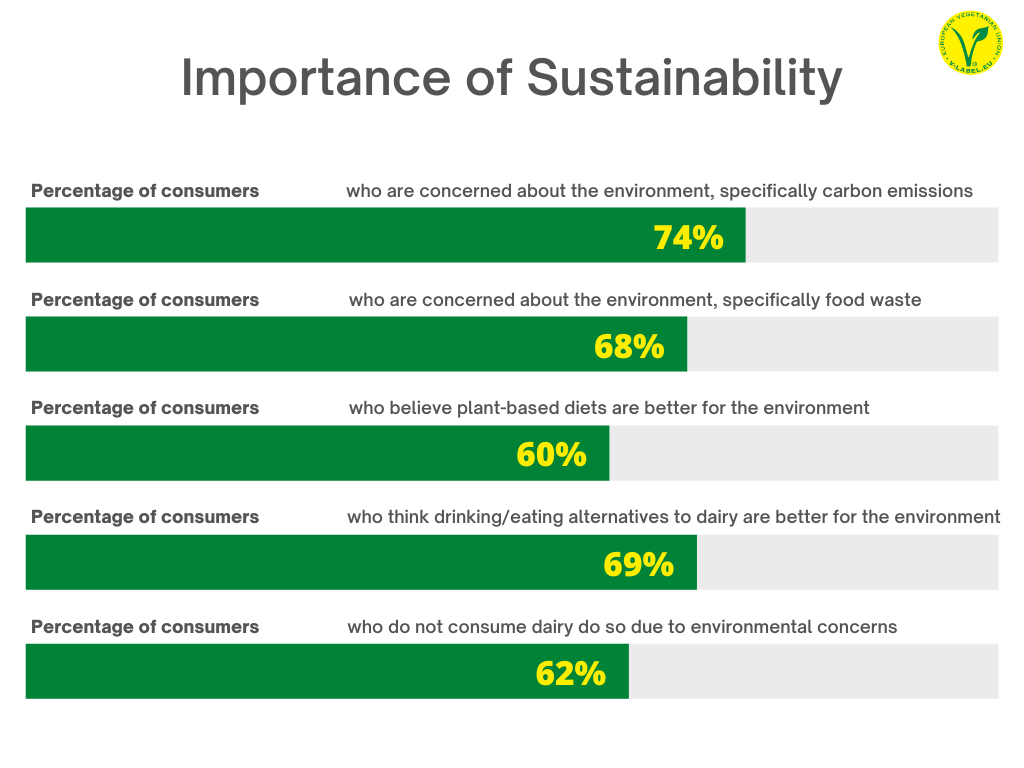

Sustainability

Sustainability has become a key factor for consumers when purchasing products:

74% of global consumers are concerned about the state of the environment and, more specifically, about carbon emissions.

There has been recent attention to the carbon emission of dairy farming and the impact this has on the environment. Therefore, many consumers have turned to plant-based dairy to address these concerns.

As a matter of fact, 60% of global consumers believe plant-based diets are better for the environment.

So there is a huge opportunity for plant-based brands to take a proactive approach to eliminate their carbon footprint and even offset more carbon emissions than they produce; brands need to be seen as resourceful and efficient – and not contributing to environmental damage.

Another major concern for consumers is food waste: 68% of consumers are worried about it.

And again, plant-based brands have the upper hand: 69% of consumers deemed that drinking/eating alternatives to dairy are better for the environment.

This is further reinforced by the fact that 62% of consumers who opt not to consume dairy cite environmental concerns such as food waste.

But beware—when asked what barriers consumers think exist when it comes to leading a more environmentally friendly diet, 53% answered that environmentally friendly products are more expensive.

And, because 67% of consumers think that price is an important factor when buying alternative dairy products, it is pretty clear that plant-based dairy brands should look into making their products more affordable or worth the premium price. A tiered portfolio range with economical options can make dairy-free products more accessible to consumers.

In short, vegan products are perceived as environmentally friendly, so plant-based dairy brands should embrace this and be as transparent as possible with sustainability claims. Also, they should aim to make dairy-free products more accessible to consumers. Brands that do this will have a positive perception by the consumer and competitive advantage over other companies.

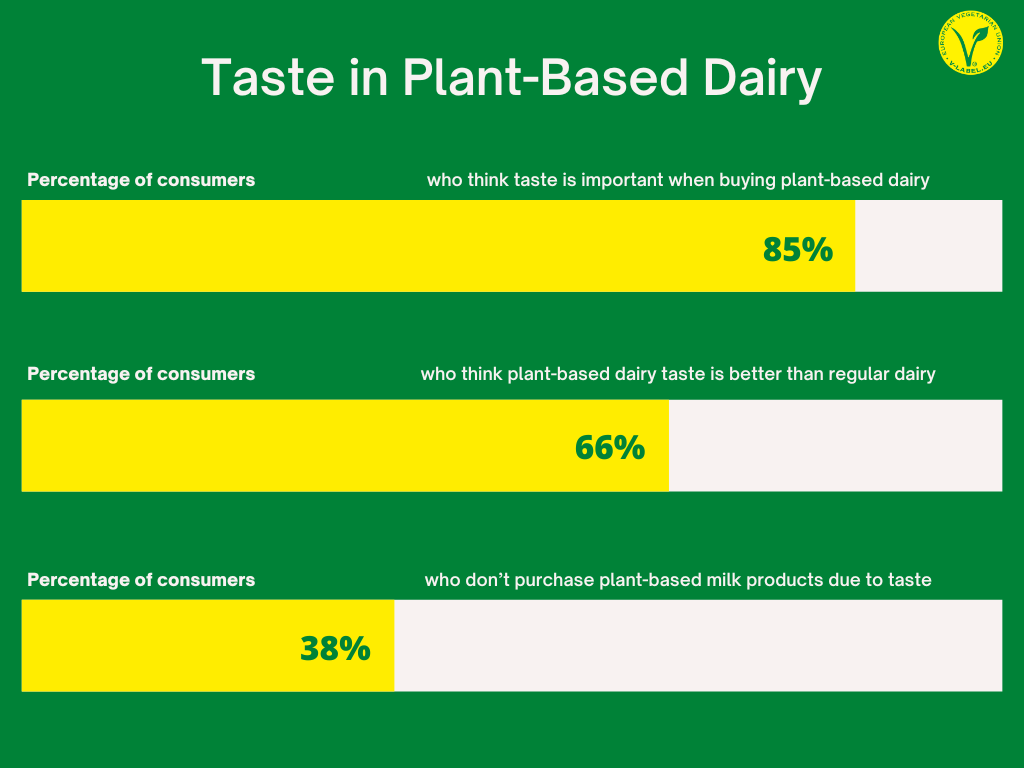

Taste & Flavors

Consumers don’t want to make sacrifices when it comes to taste.

And even though consumers have increased their attention in sustainability matters, taste is still the most important factor for many consumers when choosing a product:

- 85% of consumers answered that taste is important when buying alternative dairy products.

- In fact, 38% of consumers say that they don’t purchase plant-based milk products due to not liking the taste.

So plant-based brands should offer products that taste as good as or better than dairy products. And we can see they are achieving it: 66% of consumers like the taste of plant-based alternatives better than regular milk products.

And if plant-based dairy brands can add a variety of flavors that taste phenomenal, even better: 42% of consumers say they want a greater variety of flavors when looking for plant-based milk.

Consumers are seeking exotic and unusual new flavors to experience. With more people turning to alternative dairy products, there is plenty of room for brands to experiment with new flavors and products to offer consumers a unique experience as they branch out into plant-based dairy categories beyond milk.

There is an opportunity for brands to raise awareness of other alternative dairy varieties such as tiger nut, pea, and potato milk.

As we can see, there is ample space for innovation. But right now, the most appealing flavors for consumers are:

- Almond: 67%

- Soy: 65%

- Rice: 53%

- Coconut: 34%

- Oat: 31%

In short, plant-based brands should offer products that taste good with a variety of flavors, and offer peace of mind to the consumer by having sustainability claims.

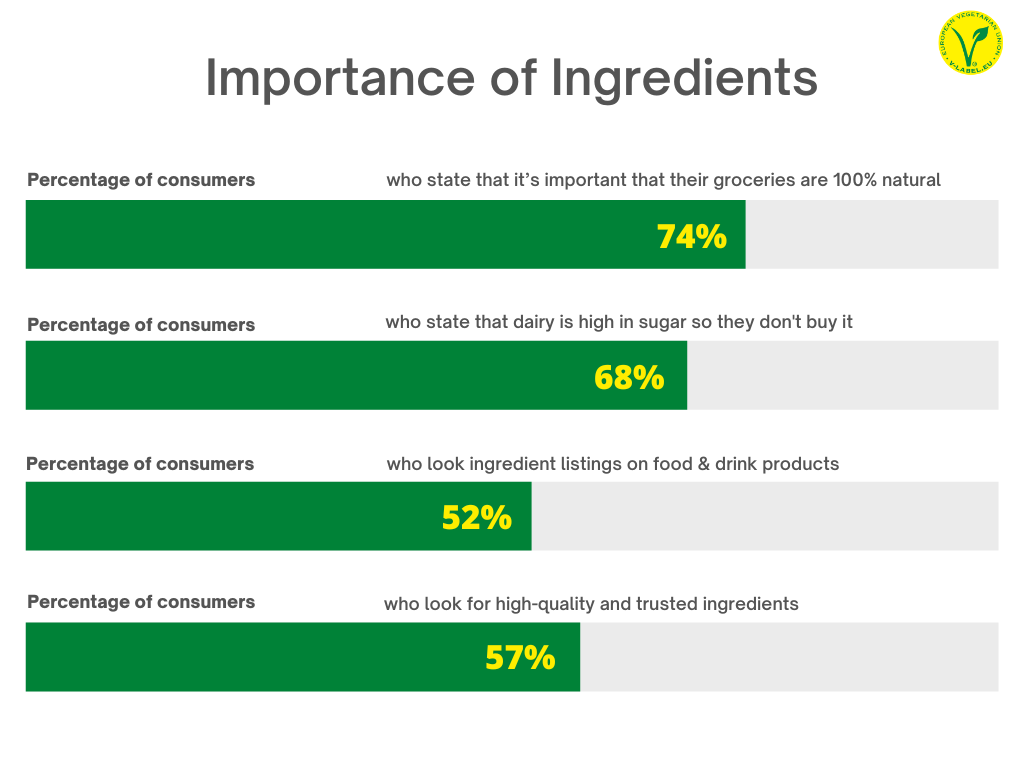

Real Ingredients

Consumers want products that contain real ingredients that will not negatively impact their health:

- 74% of consumers state that it’s important that their groceries are 100% natural.

- Also, 68% of consumers stated that dairy is high in sugar which is a reason why they do not eat or drink dairy.

Consumers are looking for clean ingredients that they know and trust, and they want to avoid chemicals and ingredients that are detrimental to both the environment and their health, so they will be looking for alternative dairy products that use familiar and trustworthy ingredients.

As a matter of fact:

- 52% of consumers agree that over the last twelve months, they have been more attentive to the ingredient listings on food and drink products that they buy.

- And when buying, 57% of consumers pay attention to whether the product has high-quality and trusted ingredients.

Therefore, plant-based brands should provide a streamlined ingredients list and free-from claims on their products to help consumers make informed purchasing decisions.

Quick fact: 78% of consumers worldwide generally trust products with the V-Label symbol more than products without it.

Health

As we’ve just seen, consumers look for natural and safe ingredients. And the main reason for that is that they are worried about their health.

Consumers are taking a holistic approach to health, looking to boost their physical and cognitive well-being and seeking out ingredients that offer a health boost beyond basic nutrition:

- 73% of consumers stated that health claims/benefits are important when buying alternative dairy products,

- and 71% of consumers indicated that plant-based alternatives are healthier than regular milk products.

Consumers are turning to functional products and better-for-you alternatives to help improve their health and boost their immune systems.

To appeal to the health-conscious consumer, brands should offer products that can provide health benefits, such as fortified products.

As a matter of fact, fortification works amazingly with flexitarians.

Due to the growing flexitarian trend across the globe (31% of global consumers are flexitarians), more people are looking to remove or moderate animal products in their diets.

However, flexitarians may feel that by removing animal products from their diet, they are missing out on vital nutrients, as can be seen in this piece of data: 55% of flexitarians stated that they are concerned that they may miss out on certain nutrients obtained from dairy due to having to change their diet in the last two years to moderate/avoid intake of dairy.

This creates an opportunity in the plant-based dairy market for fortified products to appeal to the flexitarians and ensure that they are receiving the vitamins and nutrients they feel they need.

Another key factor to consider within dairy alternatives is gut health: 56% of consumers plan to address digestive health over the next twelve months.

As data shows, this is a major concern of consumers. How do they plan to tackle it?

The answer is probiotics.

The problem is that many consumers associate probiotics with dairy products.

Therefore, plant-based dairy brands should look to provide the same probiotic benefits as dairy products so consumers don’t feel like they are missing out when removing dairy from their diets. Fortified products geared toward digestive health, such as probiotics, may be the answer.

Get our latest webinar on Gut Health & Dairy alternatives to learn from medical and industry experts insights on consumer needs, trends, and product development.

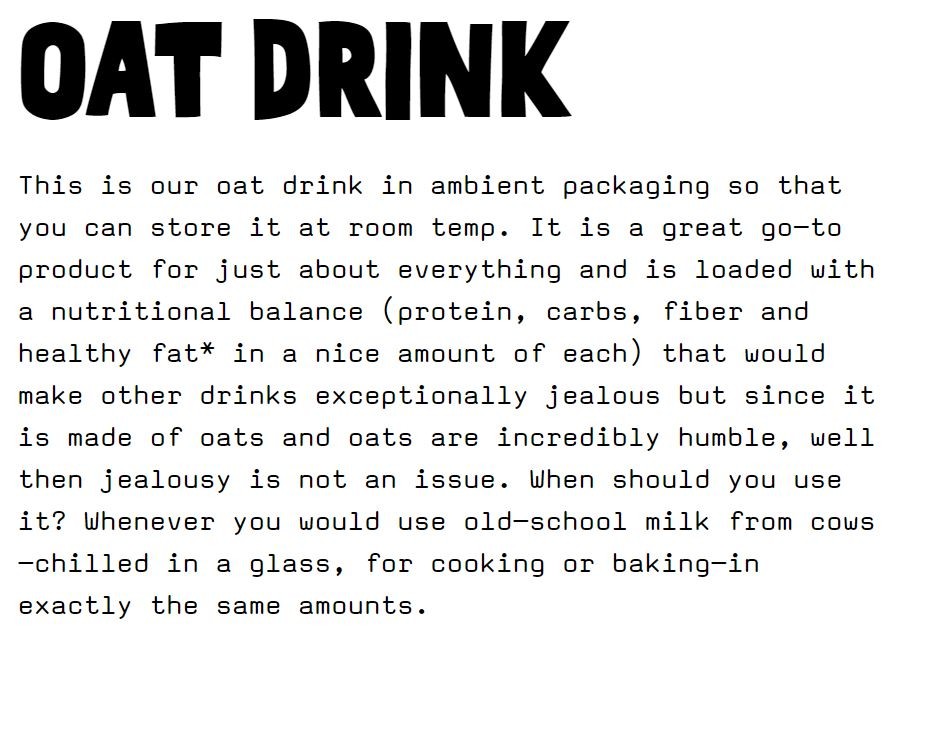

Practical Example: Oatly

In our last newsletter, we provided a practical example of how Heura communicated to consumers the environmental impact of its plant-based meat products and the composition of its ingredients to demonstrate that its product was sustainable and healthy.

In this edition, we will use Oatly as our practical example.

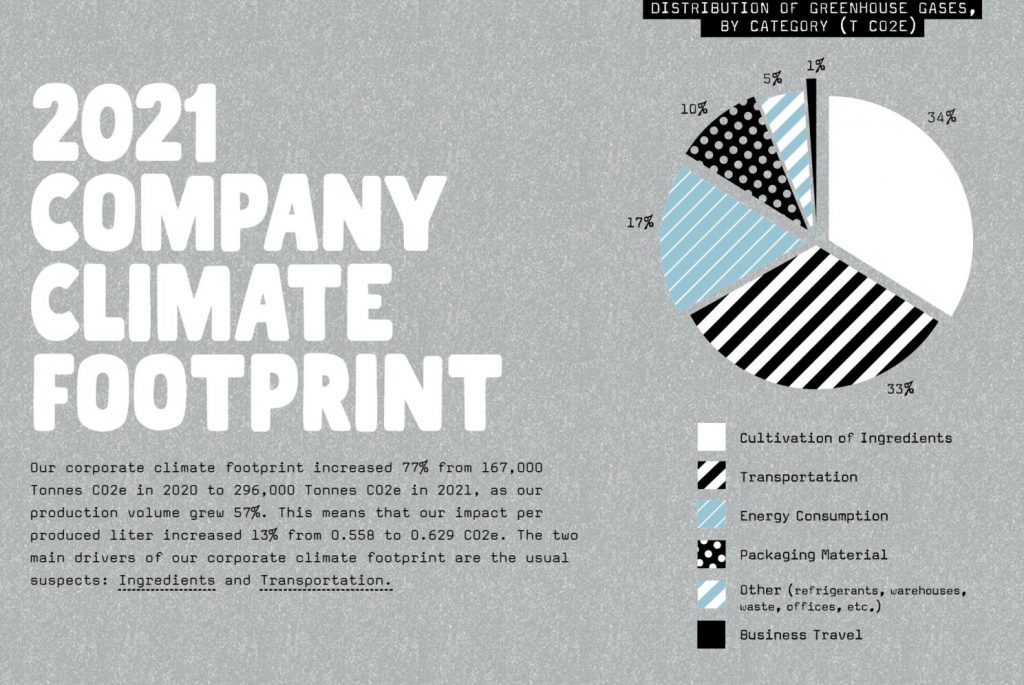

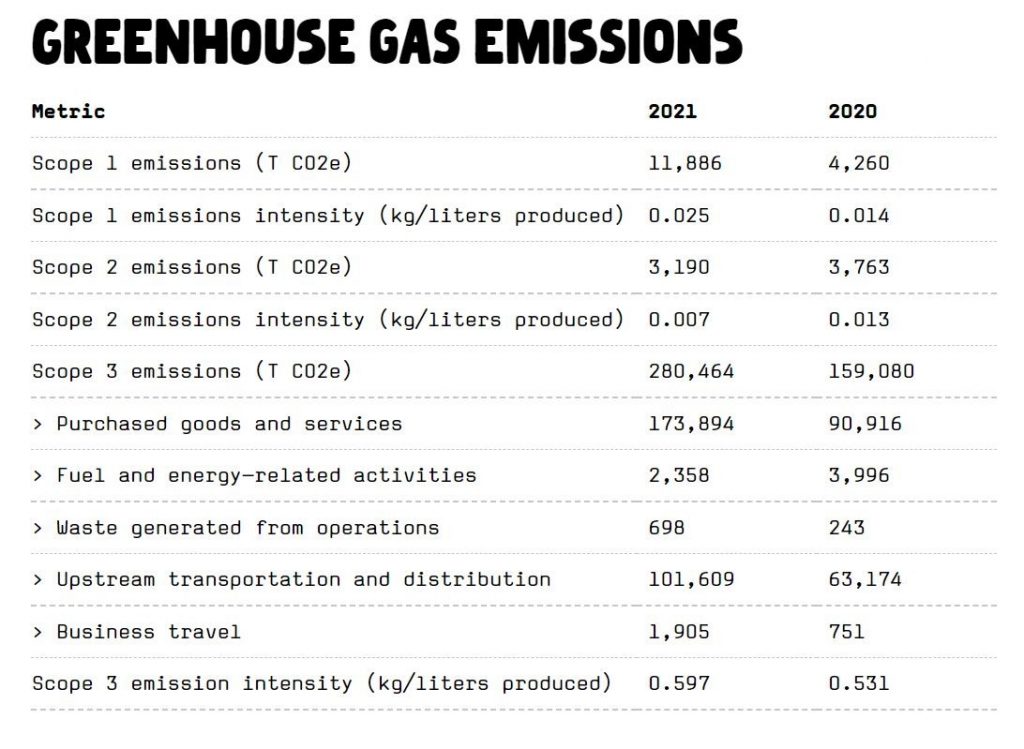

As we can see, Oatly focuses on two things: its climate footprint and its ingredients, letting the consumer know what they are getting (just oats with protein, carbs, fiber, and healthy fat) and its environmental cost.

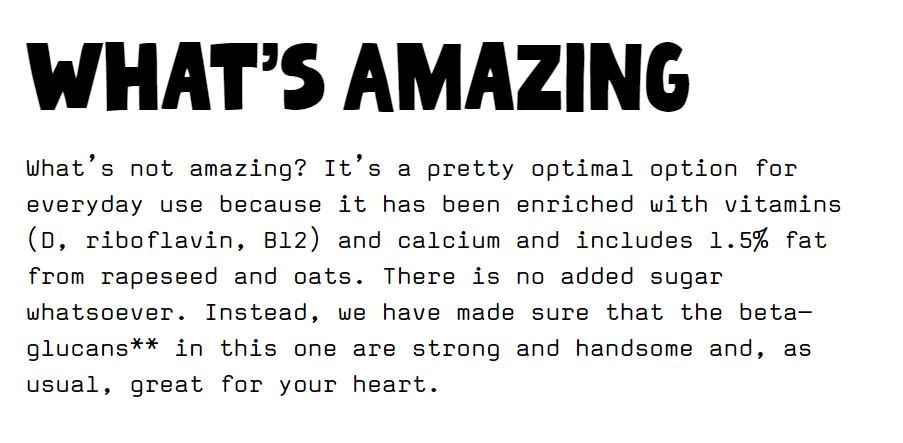

Oatly lets the consumer know that the product has been enriched with everything they need: vitamins and calcium. The ingredients are natural and healthy, so consumers don’t perceive that they’ll be missing any nutrients. Remember what we said about consumer concerns about missing out on those.

Oatly goes a step further and provides the consumer with detailed information about the ingredients they use:

Consumers highly appreciate this transparency, so it makes sense to commit to it even when communicating negative aspects of the product.

Here, Oatly addresses a possible concern: the presence of sugar, an ingredient poorly perceived by the consumer, as we have stated before.

Oatly communicates its environmental impact to the consumer openly, even if it has increased.

Being so open about their strengths and flaws is what makes Oatly gain consumer trust. And looking back, Oatly meets all the key factors mentioned in this newsletter.

So vegan brands should consider following this example to increase their chances of winning consumer trust.

Now it’s your turn

We really hope you enjoyed our new consumer insights guide. If you want to learn more about this topic, we have a whitepaper on the key innovations and market numbers of plant-based dairy.

And now we’d like to hear from you.

Which consumer insight from today’s guide did you find the most useful?

Are you going for an environmentally friendly product with health claims? Epic taste and natural ingredients?

Either way, let us know by leaving a quick comment below.

See you in the next guide.

List of Resources

- Case study: How do conscious consumers shop beyond 2020?

- Plant-based Dairy whitepaper: Innovations and market numbers

- Dairy alternatives & Gut Health Webinar: Consumer needs, trends and product development

- Get the V-Label

This data was extracted from FMCG Gurus

Argentina

Argentina België (NL)

België (NL) Bosna i Hercegovina

Bosna i Hercegovina Brasil

Brasil Chile

Chile 中国

中国 Česká republika

Česká republika Colombia

Colombia Costa Rica

Costa Rica Danmark

Danmark Deutschland

Deutschland Ecuador

Ecuador España

España France

France Ελληνικά

Ελληνικά Hrvatska

Hrvatska Italia

Italia Lietuvių

Lietuvių 한국어

한국어 Magyar

Magyar Lebanon (EN)

Lebanon (EN) Melayu

Melayu Mexico

Mexico Nederland

Nederland Nigeria

Nigeria Norge

Norge Österreich

Österreich Perú

Perú Polski

Polski Português

Português Română

Română Русский

Русский Slovenčina

Slovenčina Türkçe

Türkçe South Africa

South Africa Suomi

Suomi Svenska

Svenska Schweiz

Schweiz Українська

Українська الامارات العربية المتحدة

الامارات العربية المتحدة Tiếng Việt

Tiếng Việt